CMM – Category Management Mondays

For this week’s Category Management Monday’s first update, I decided to go old school. The one, the only, and the original from AT Kearney. And since a diamond is a girl’s best friend, what’s better than to bring up the Strategic Sourcing Gemstone (close enough, right?). This beauty was eventually updated to the AT Kearney purchasing Chessboard, but there is something about the simplicity of it that I really like.

The graphic alone is a lot easier to digest and take in than Chessboard. For one it’s not an eye chart and two, it doesn’t have an entire book dedicated to understanding it! So whether you are new to the trade, or want to introduce category management to a new business partner, it’s a great graphic to have in your arsenal.

Tip for the week: There are lots of uses for this old school sourcing tool! #dontforgettheclassics

Spend Analysis. Divide a cube of spend into nine pieces, (a three by three cube is easy to analyze). Look at each dimension, total spend and then by the other side. Summarize each side in ta separate slides and then consolidate to one. Who said this had to be hard?

See also: Rate Analysis Blog

Category Management Mondays

My first boss in GSS always told me that in our jobs in Category Management, we had a toolbox – part of the larger process. We always carry the ability to use all of these different tools. But it doesn’t always make sense to do so. It depends on the category, level of engagement and business partner. Each job requires only tools that make the most sense for it.

But it is a nice standardized framework to refer to. Especially when moving into new categories. Eventually I’d like to drill down into each of these tools and explain best practices.

Tip – Don’t try to use all the tools every time! Every Category is different and focus on the ones that are most relevant and useful.

What is an Opportunity Analysis? Well simply put it’s finding the best practices for finding value in a sourcing process (leveraging the gemstone/chessboard). It’s taking all the information you have: stakeholder interviews, brainstorming sessions, market data and benchmarking and reviewing them to analyze the need for process improvements and potential savings opportunities.

This may sound easy when you see it on the surface, but the truth is that it can be a very complex task. There are multiple factors you must take into consideration. There’s lots of data and information to review. So if you miss something or incorrectly prioritize something else, it can drastically change your strategy.

Tip(s) of the Week: Don’t let your past experiences, create your future ones. People rely on what worked well in the past, so kick old habits. Include new business partners in a brainstorm – create a hypothesis, test and repeat. Don’t rely on status quo.

Second, technology is constantly changing. Update your benchmarking, industry insights and market data in the least yearly (if not quarterly). You don’t want to miss an epic opportunity due to stale data.

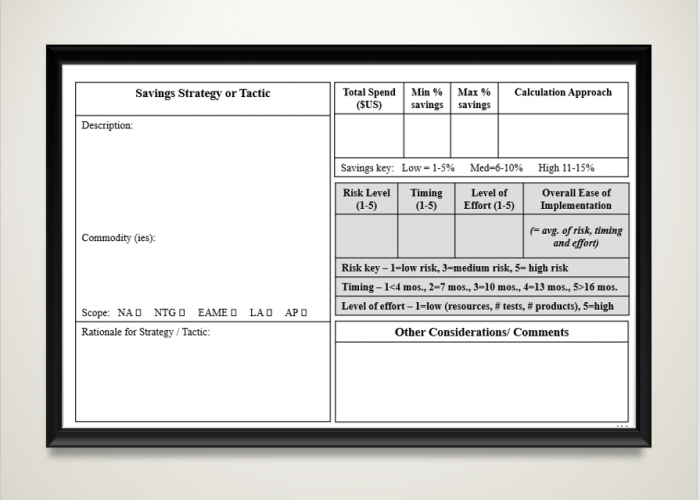

Have you finished your opportunity analysis? If so, this week of Category Management let’s review this week on how to prioritize each opportunity based on the estimated savings potential and ease of implementation.

Steps to identify opportunities on the Prioritization Matrix:

1. Buy Market Research / obtain benchmark information on savings potential

2. Meet with business partners to review their budgets, potential sourcing opportunities and gauge their level of interest

3. Review the potential for bundling similar services/products for additional volume leverage (generally speaking if spend is <1M)

4. Map out estimated savings and ease of each opportunity to determine which opportunities should be addressed first and in what approximate order. Plot each below on the matrix by:

- Estimate savings and other cost avoidance/soft savings opportunities or benefits by using benchmarks, interviews, and past experiences

- Revisit notes from business partner meetings to estimate their willingness or “ease” of implementing each opportunity

Tip of the week: Make sure to print out the map you create and put it on your desk or somewhere you can visually see during the day. It will give your subconscious a visual reminder of what’s most important and ensure you take steps not just to answer emails, but focus on the bigger picture.

Additional tip: You can make the size of the bubble that represents opportunity (on the matrix) – relative to the size of savings. Ex: Huge savings potential – very larger bubble; small savings – smaller bubble. This will help visually represent the opportunity (for all you visual learners!).

As a first step to structuring a project based on your opportunities, a project charter should be written. You want to ensure that it clearly defines what the project scope is, expected results and your key stakeholders (business partners). In the below slide, you can see six sections that are needed to help you keep focus for the duration of the project. This is especially important when engaging in very complex and lengthy projects.

Ensuring stakeholder buy-in for a project charter helps to:

- Provide functional expertise and experience

- Confirm support for sourcing approach

- Provide resources to support the project

- Make key decisions / final approvals

- Facilitate implementation

- Provide leadership direction and support

Pro Tip: Don’t skip this step! I know it seems like a trivial step, but putting things down on paper helps to solidify them. I personally tend to move fast and skip things that appear to be low value, but this isn’t one of them. Project plans provide a clear definition of your intentions and plan to move forward.

For this week’s addition to Category Management Mondays, we continue to the next step of the process. And wouldn’t you know it, it’s creating a project plan. Shocking I know, but our jobs don’t require us to be rocket scientists, just part-time project managers! In creating a project plan there are five clear steps in the below slide. All of these things are typical for any type of project management you may do.

Pro Tip – If you are like me and project planning is the bane of your existence, as it seems only to be a step to slow you down – I have a fix. You have to change your mindset. Tell yourself you love it and it’s what keeps you on track. I like to believe I will remember it all, but that’s not always a fact. And remind yourself that you can’t forget something if it’s written down and you can see it, but you will if that’s the only place it’s located. There’s limited space in there!

Pro Tip 2 – Make sure you have a place to store all of this information to pass on when you leave. SharePoint, Google Docs, internal cloud databases, they all work. Because the last thing you want to do is leave the company / next Category Manager up a creek (or maybe you do… who knows!). It also allows you to stay organized and revisit when you need to remember who was involved, what happened and why.

For this week’s edition of Category Management Mondays, I wanted to recap the most important CatMan (Category Management) tools. I took a look back at what I was initially trained on at Amgen and made some tweaks. Although I agree with the majority of the company’s once “must have” suggestions, I’ve found in my current role what’s work best for me.

You can read the slide in order like you would a book. The first line starts with an opportunity analysis and the second supplier perspective. These would be the respective order you should complete the actions in. Unfortunately, if you don’t have time to complete them sequentially, you can always do the matrixes in parallel. Nothing like a little time management to speed up the process when needed.

I also excluded something that is very important if you are working on direct materials and even some indirect. Which was the Risk and Vulnerability Matrix. When I take a look at most marketing or indirect services, the risk/probability of occurrence for an event is typically under the “No Action.” And thus my rationale for exclusion. I also added in the Gemstone/Chessboard and prioritization as I think this is something that was critically missed. Every time I need to come up with ideas, I tend to go back to this step (and thus the addition).

Pro Tip – Not every company or category is the same. You should always reassess what’s needed dependant upon your industry, spend and the category baseline (what’s been done previously).

In the initial phase of any project, you’ll want to get to know your business partner. And if you are like me, you sometimes struggle with exactly what to say.

ProTip 1- for the week is to create and tweak your own interview guide. If you have a structured approach, you’ll be able to go back and reassess your notes quickly and concisely to get the information you need. It also will provide for a guideline to ensure if the conversation goes off topic, you can always steer it back to move your project forward.

ProTip 2 – If you ever have a hard time starting a conversation with a business partner you can follow these three easy steps to break the ice:

1. Schedule it in their office or where you have to walk by their cube/space

2. Try to find something in common (comment on kids pictures, or other things posted in their space, or find them on LinkedIn/FB to see their interests) to talk about

3. If all else fails – give a compliment! But be genuine and specific. If you leave them scratching their head on why you told them you like their basic khaki pants, you’ve done more harm than good!

This edition of CMM, we are talking about the infamous business or hierarchy of needs (AQSCI or AQRSCI) for category management review. It’s extremely necessary to carefully define all the wants, needs and nice to have of the business. Just like a pyramid, you need to have a sound foundation, to be able to build to the top. Without it, the entire structure crumbles.

Pro Tip 1 – Once the basic business needs are satisfied (assured it can be provided and at the quality you need) then the ‘Business Wants’ become more important. Sometimes it’s hard enough to get the bottom intact, so you should try to focus on this first. Don’t let business partners persuade you to think otherwise!

Pro Tip 2 – If key business requirements are not met, there is a huge opportunity for a #Category Management Fail! Make sure you evaluate all business needs and don’t forget to define constraints and enablers for each category.

It’s the last week of June and we are all trying to make it to the 4th of July for those precious days off!

This week’s edition, we will continue to move through the core tools I presented earlier in the month. After moving past the business requirements, the next portion is to assess is Category, Spend and Market Research (the triangle). Since I’ve already covered Spend Analysis, let’s focus on Category Analysis.

One of my least favorite exercises is the total cost of ownership (TCO). I say it is my least favorite because there are so many things to take into consideration, it’s easy to forget one or two. Additionally, if you end up using average costs, your TCO can become basically worthless.

Pro Tip 1– when going through to asses base price + delivery costs + lifecycle costs + switching costs = TCO, make sure you track and record all of your costs in a list. You need to be able to keep track of even the smallest costs including internal staff costs to train and implement a potentially new system.

Pro Tip 2 – Try to find someone who has sourced the same category prior. This way if there are very small or specific switching or life cycle costs you might not realize, they are sure to be able to bring them to your attention.

Can you believe it’s already July 1st! Just a few days away from what I consider the halfway point of the summer.

So for this week’s edition of CMM we are going to look at the last leg of the analysis triangle. Market research! One of my favorite parts of category management.

When you think about Category Management Research, it really can be divided up into three parts. Primary/secondary market research and data in the category, competitive intelligence with benchmarking against your peers, and the third the final analysis and how each comes into play when making a category management strategy decision.

Collecting all this data on your own is a daunting task. The phone calls, the database searches, creating an exhaustive analysis of Porter’s five forces. The list goes on for what feels like an eternity.

That’s why most companies outsource this portion of the process. Especially when there is a multitude of companies who update on a quarterly basis the most used categories and have industry updates within them. Why re-invent the wheel? You need to keep up to date with the trends, but not spend all your time researching them.

Pro Tip 1 – Outsource this if possible. There is a multitude of companies who provide canned market research for categories and a very low cost. Even if your budget is under 1k, it’s worth the spend (vs. your time).

Pro Tip 2 – A couple of companies that I’ve used in the past, who provide category intelligence are the Smart Cube and Beroe (GEP). Others that I’ve seen (but haven’t used): CASME, CIPS, Source One, Spend Edge, Gartner, and Procurement IQ.

I’m sure there are a plethora of companies out there (including category specific companies such as advertising agencies, supply chain focused, etc.), but the ones mentioned I have consistently heard over my career.

Current Position Analysis

The current Position Analysis provides market and pricing drivers from the client/supplier point of view. This matrix is pretty straight-forward and simple. Single suppliers in a market place will drive higher prices and multiple suppliers drive pricing down. And the number of customers in the market place can also drive pricing down.

Pro Tip 1 – A structured 2×2 matrix (like the current position analysis) is an effective tool that can communicate insights by turning complex ideas into simple options.

The matrix can provide a bigger picture of options that are MECE* and is generally divided into four squares that have their own distinct options/strategic choices. Each option or choice is plotted into the matrix by looking at two key factors. The two dimensions must independent from each other for the matrix to work.

Example: Amount of time vs. spend per project

When used correctly, it can make you look like a sourcing Rock Star!

*MECE is a way of segmenting information into sub-elements that are mutually exclusive and collectively exhaustive. Elements ‘exclude’ each other (are different) and are ‘exhaustive’ (full comprehensive – considers all aspects).

The Supplier Perspective Analysis provides you (as the business) the strategic insight to how valuable and attractive your account its. Albeit simple, having the insight to what your counterpart on the other side of the table is thinking is invaluble. Just think about going into a negtiation where you are the smallest vs. largest account with one of your suppliers. Your strategy for each of them would be vastly different.

If you are at a large corporation spending hundreds of millions of dollars, your life should be just a little bit easier than us at the bottom. Everyone is knocking down your doors! So enjoy your position in having the leverage.

Pro Tip 1 – But if you are on the lower end of the spend spectrum, you must find the partners of the right size to accommodate for this disparity. Nothing is worse than being rejected for an RFP because you are too small! So understanding your place relative to the larger market is key in who you approach and work with. The tool is simple, yet effective even prior to negotiations!

The Matrix was first presented in 1983 in the Havard Business Review – Article Link.

The matrix is all about segmenting suppliers. Why? Risk management. If a single supplier can have a high impact on your revenue or stop your production all together, they should be high priority to your business. You’re going to want to know, and treat them a little bit differently than you do Staples.

Therefore, using this matrix to simplify the situtation prior to negotiations and category assement is critical. The last thing you want to do is aggravate a supplier on the right side of the matrix, where supply is low and they have more leverage.

Pro Tip 1 – No matter the situation, there are always alternatives and preparing for them is key! Even if it means using a bit of innovation in helping a new supplier to produce something that isn’t part of their typical supply chain.

Following suit from previous weeks, I’m at the last phase of the ‘Core Tools’ I showed you on 6.3. I can’t say that I can do the purchasing board justice. The book is immense and it has lots of information in it. So if you have 5 minutes check out the three slides below. If you have 5 hours check out the white paper, and if you have 5 days check out the book!

Pro Tip 1 – It’s expensive, but buy the book, as it’s something you will always be able to refer back to. And take notes – writing helps you remember these things!

Pro Tip 2 – For more context/cliff notes version – check out the IIAPS White Paper. It’s free and very useful!

So we are finally at the last point of the ‘Core Tools’ kit on 6.3! How exciting, we are going to be able to put everything together to come up with a category strategy.

Now if you’ve been able to complete all of the core tools, you have a lot of information infront of you. So the question remains, what in the heck should you do with it? Well, I like to view this as a big puzzle, and you’ve currently just got all the pieces. The trick then, is to see how each piece interconnects to come up with the bigger picture!

Pro Tip 1 – Whiteboard all of the information. If you are a visual learner, putting the most important points out in front of you will help you figure out the best strategy. (If you don’t have that big of a wall, use powerpoint and print out the pages instead).

Pro Tip 2 – Create a strategy, then go back through each of the tools and see if it makes sense to continue on with that strategy.

Ex: You are buying Advertising / Media as a very small company and have very little spend. You decide to find niche agencies (3 max) or smaller companies to work with and consolidate your spend. But, because your account isn’t large enough, you decide to always bid out the work to ensure pricing stays low.

So if you go back, you must think through things like:

- Will these agencies meet all of the business partner’s requirements and priorities?

- How will this impact the current spend with suppliers? How hard will this be to implement by reducing the number of agencies we work with? (rates, discounts, etc.)

- Does this make sense given the current position?

- Does this strategy align with supplier perspective or are we still a nuisance of an account instead of in the core quadrant?

- Are we ensuring that we aren’t creating any market risk with this strategy?

Pro Tip 3 – When all else fails, ask for a second opinion from a peer or boss! It’s amazing what another person’s viewpoint can shed light on!

Finally we are into a new chapter of #CMM – Category Management Mondays. And to start it off, one of my favorite topics, make vs. buy. Now you may be thinking, what does this have to do with Sales & Marketing Category Management?

Well let’s start by defining it. The make-or-buy decision is the action of deciding between manufacturing an item internally (or in-house) or buying it from an external supplier. These typically are made when a manufacturing company has a hard time getting quality products with current suppliers, or deman is extremely high (and you want to reduce variability). But, it can also be used in the Commercial landscape, but you may ask how?

Well, most recently the trend has become to in-house parts of the marketing process that we’ve typically outsourced to agencies. According to ANA’s 2018 report, there was a 34% increase in the number of in-house agencies, with an 80% overall satisfaction rate. And this number is projected to rise. Just check out this article to find out more about it – Rightspend Blog.So how do you go about figuring out which pieces you should bring in house? Well I’m glad you asked! Here’s a couple protips for you.

Pro Tip 1 – Start by mapping the work on the below matrix. Ex: If creative ideas are on the low portion of competitive advantage like a product might be in ultra rare disease states (we have no competition) then it makes sense to in-source the majority of this work. Because a highly strategic plan isn’t going to make the needle move against impossible competitiors, the risk is low and it’s under an acceptable tolerance to in-source.

Pro Tip 2 – Agency staff are known to flip flop between client and buy side (working for an agency vs. their customer internally). So when completing this analysis, take into account the talent pool you will need to have to either do creative work, media buying, or any other activity.

Pro Tip 3 – In-housing agency work is on the rise for a reason. You basically have the agency without the incentive to make a profit on each project. And as a FTE full time employee – they will be truly vested in the decision making for the company (versus the external resource). So just do it!

There’s risk invovled when working with suppliers who provide critical items to your supply chain. Therefore, it’s Sourcing’s job to mitigate that risk so the business doesn’t have an issue if their only supplier gets hit by a bus. Or a train.

Pro Tip 1 – Know where your commodity fits on this 2×2 grid. And even if there is low risk, have a back-up or contingency plan. I would suggest even low risk items should have a secondary supplier (at least identified and potentially contracted) for use. Because nothing is worse than trying to validate and on-board a supplier when you are in a time crunch!

There’s something to be said by a simple, one page summary of your category strategy. I’ve compiled a few for you to review and use to make something of your own! Take which ever parts make the most sense for your category, strategy and company and it will provide you a great talking point when speaking to business partners (and it will make you look smart too!)

Pro Tip 1 – If you like any of them, either screen shot them, or email (mscategorymanagement@gmail.com) me so that I can send you a powerpoint picture/pdf for you to use!

Check out this week’s Category Management #Protips!

ProTip 1 – Know your style. And know your competitor’s (If you can figure it out). This gives you a leg up on the process.

ProTip 2 – View suppliers as partners, and find those who do the same. This will save you exponential time in the negotiation process. From months to days, it can make a huge difference!

After an interesting discussion on LinkedIn last week, it made me remember this SRM curve. What it is telling you is extremely straight forward. If you don’t follow-up and strategically manage your suppliers using KPIs (Key performance indicators), QBRs (Quarterly business reviews) and other SRM techniques, you stand to lose value from your suppliers.

Why even put forth all the effort into negotiations, business terms and contracting, if you are going to let it all fall to the wayside?

Pro Tip 1– So don’t miss the last and most important piece of the category management process, SRM! Without it, all your work on the front end can be quickly lost!

ProTip 2 – Find another organization in your industry and identify the tools and processes they use for SRM. Why reinvent the wheel if you can borrow best practices (or get them from bechmarking!).

I am not a fan of having to do this myself! But there are some great sites out there if you want more in-depth knowledge. This is a KEY tactic when it comes to understanding the larger market speace, so make sure you get it down. Without it, your negotiation plans could be a moot point!

Link to Video of Porter’s Five Forces – Investopedia

But here are the basics of what goes into each area (if you need them…)

Supplier Power: Number of suppliers, size, uniqueness of service, ability to subsitute, transition costs

Threats of New Entrants: Time and cost to enter, specialist knowledge, economies of scale, cost advantages, barriers to entry of the market place

Competition: Number of competitors, quality differences, switching costs, customer loyalty

Buyer Power: Number of customers for a product/service, size of account/orders, differences between competitors, price sensistivity, substitutes

Threat of Substitutes: Substitute performance and/or quality, cost of change

Pro Tips for the Week:

Pro Tip 1– Pay someone else to do this, it’s not that much fun!

Pro Tip 2 – If you have to block off a day or two, so you can think things through. Multiple times. It’s not as easy as it looks. And take it in stages if you have to. Start with market research, organize then validate with other SME’s.

I don’t think I’ve specifically called it out before, but I’ve just made up this graph on best practices for managing suppliers throughout the product life cycle. Try to google it. You’ll be as frustrated as I was for months!

I personally focused on Marketing and advertising, but am pretty sure it’s applicable to most other suppliers too. Especially ones who have long standing relationships. They should always be finding efficiences and partnering with you to discover best practices/pricing.

Pro Tips for the Week:

Pro Tip 1– Check out my blog post on the subject (if you have the time) for an overview

Pro Tip 2 – If it isn’t out there and hasn’t been created, make it up! You’re never going to be the only one asking a question. So answer it for all those who need it! When you become a tenured, share your knowledge. I promise, it will give back more than you could ever give!

Have you ever had a category or sourcing opportunity that has been assigned to you with no previous knowledge? Or have you ever wondered how to implement a quick sourcing strategy to ensure diligence, but meet ridiculous deadlines that can be put on by upper management? Then this is for you!

We don’t always have time for the full 7-step sourcing methodoly. That’s where Opportunitistic sourcing comes in. It makes sure you have your bases covered, and provides you with the data and basis for a solid sourcing strategy. Just check out the graphic below to see what it entails.

Pro Tips for the Week:

Pro Tip 1– When you can, go through the full seven step process. If not, this is a great way to execute (very quickly) a solid sourcing strategy. Every step is extremely important, so don’t cut corners and miss one!

Pro Tip 2 – ALWAYS back whatever strategy you have with data. Market research, internal, etc. It’s the key to gaining trust and building relationships with your business partners.

Pro Tip 3 – Check out my new LinkedIn Page and sign up for special posts daily! Ms Category Management – LinkedIn